My first memory of handling money was in the first grade. My school offered savings accounts for all students through Barnett Bank (now Bank of America). Once a week bank representatives would come to the school and collect our deposits. The night before the deposits were collected, I would sit with my mom and fill out the deposit slip. The next morning, an announcement was made over the loudspeaker for all students with Barnett Bank accounts to make their way downstairs with their money and deposit slips. I remember being so excited and feeling extra special walking swiftly downstairs to the front office with my one dollar and slip in hand. My pigtails with hair bows clamped on each end swaying from side to side. “Hello, Ms. Gibson, I see you have a deposit today.” I’d smile and hand over my one-dollar bill and the Barnett Bank deposit slip to the representative then wait to receive my receipt. I can’t say I fully understood what I was doing. But I for sure knew that from one week to the next I would have one more dollar than I had the week prior. It made my six-year-old little self feel accomplished. Learning to save at an early age was one of the greatest gifts given to me by my mother. I felt empowered knowing that I had money in a bank account that was mine. It was a thoughtful gift my mother, probably unknowingly, gave to me that would stick with me for the rest of my life.

Fast forward a bunch of years! I’m in my 30s, I have a family of my own and loads of financial responsibility. When I first began my finance journey I used online websites like Mint to help me stay on top of things. I also set up a budget in excel and to be honest, I absolutely hated it. Let’s start with Mint, there were a lot of areas I was unable to complete because they did not apply to me so the information and graphs were incomplete. I also did not like receiving so many emails and updates everyday about my account. It’s annoying. The Excel spreadsheet…chile. I mean, it was so tedious and the esthetic looked like something from an old video game. If you’re over the age of thirty you know exactly what I’m talking about (Mario, anyone?). I could not get with it. So, of course, I quit it. I had to be honest with myself and understand that I’m a paper and pen kinda girl. I love grabbing my fancy pens and highlighters along with whatever paper template I’m using at the time and sit at my desk to write everything out. There’s something magical and therapeutic about writing out my line items and numbers that works like magic for me and keeps me motivated. Plus, as you would guess, I love to write. I also believe that highlighting is one of the best creations in the world. Anyway, because I can feel myself going down a rabbit hole, I found that the paper and pen system works well for me. It helps ease my anxiety around money, keeps me organized, and is a beautiful way to keep everything in one place.

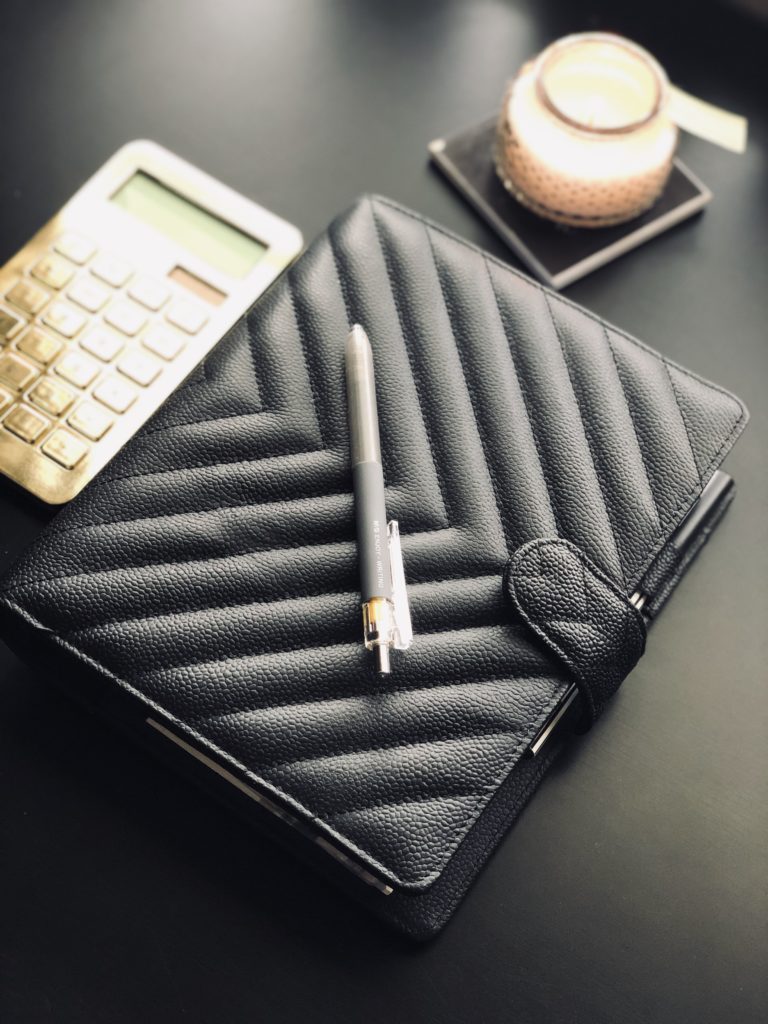

Pen | Cloth & Paper Penspiration Box

Gold calculator | Home Goods

DW Home Mini Candle | Home Goods

You would know, even if you don’t know me well, that I have a love for planners. My first planner was a fuschia personal size Filofax that I still have to this day. One day while going through the finance section in my Louis Vuitton personal planner I got the fabulous idea to create a personal financial planner. I knew I wanted it to be pretty, chic, and minimalistic. After literally researching planners for weeks I finally decided on one I felt was perfect for my needs and not to mention beautiful. I wanted A5 size because it would provide space for me to write legibly, add notes, stickers, and hold a sizable amount of paper. I purchased dividers, a notepad for random notes, a pouch to hold extras like stamps, deposit/withdrawal slips, stickers, and coupons. After giving the planner my final personal touch, it was ready to be used and I was on my way to financial organization. I must say, outside of other major financial decisions; purchasing a planner to organize my finances was a really smart decision.

Simplicity Card & Memo Page Marker | Cloth & Paper

Bow Paper Clip | Kate Spade

Black & White Notes Card & Clip | Sessa Vee

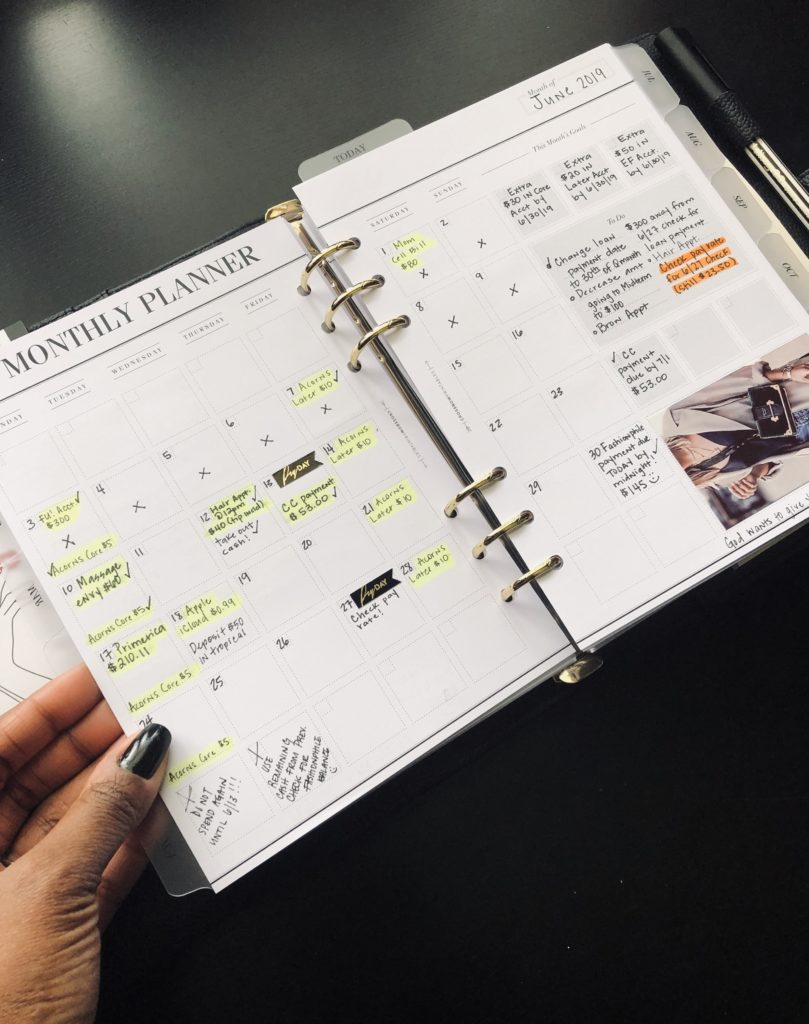

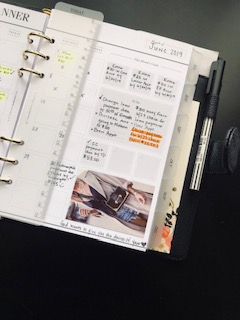

So how do I actually use the thing? The planner opens up to a set of monthly dividers (January – December) and that is where I keep track of my monthly budgets. I keep the entire year in place to use as a reference. The last week of every month I create a budget for the upcoming month. How I actually set up my budget will come in a later post. Once the budget is created, I write everything out on a monthly calendar so I can see all my bills at-a-glance. To be honest, the numbers for my personal budget don’t change much, which means I can use the same numbers from the previous month and tweak numbers where necessary. Remember when I mentioned earlier how planning eases my anxiety? This is how. Seeing the month laid out lets me know what’s to come and takes away the guesswork. I often make notes about anything pertinent that I need to give special attention to, specific deposits to make that month, directions on what to do with extra cash, etc. If a bill increases, I make a note of it in the note section and apply it to the next month’s budget. As bills are paid, I place a checkmark next to it in the planner so I know the transaction is no longer pending. If a bill was more than what was budgeted for (hardly ever happens) I also make a note of that because then the budget has to obviously be adjusted.

Pilot Ball Liner Pen | Cloth & Paper

Clear Plastic TODAY Page Marker | Cloth & Paper

I gain momentum through setting goals. The feeling of reaching a financial goal is rewarding. Each month I set three small financial goals. Even if they are the same every month I still commit to setting and reaching them. For example, I may set a goal to deposit an extra $50 in my emergency fund by the 30th of the month. I love to learn, so I also set a goal to read two financial articles for the month, read a personal finance book, watch a YouTube video on finance, or listen to a finance podcast. These goals are listed on the same page as my budget so that I see them multiple times a week and remember to work on completing them. Otherwise, I’d list them on an actual GOALS insert included in my finance planner and keep track of them that way.

Finally, because I’m a creative at heart, I found a way to include an inspirational picture on my budget/planning sheet that represents a larger goal I’m working toward, an item on my wishlist that I’m saving for, or just pure inspiration. I call it a mini vision board because when I look back over previous months, the collection of pictures looks like a mini vision board. The pictures keep me motivated towards all my goals and also serve as a reminder to stay focused on doing what is right for myself and my family financially.

Monthly Planner A5 Inserts | Crossbow Printables

The downside to my financial planner is that it can be quite expensive. No package deals here! Lol! The planner, dividers, dashboards, stickers, A5 monthly planning pages, pens, clear zippered pocket, notepad, GOALS inserts, etc. were all purchased individually or received in subscription box years ago. If I had to guess I’d say I paid about $200-$250 for everything. Also, the inserts have to be repurchased every year. However, the dividers are made from durable plastic and I should have them for some time. Same for the planner. It is made from a high-quality caviar leather. Pretty cool, right? The extra fluff (notepads, stickers, fancy pens) is definitely not required to get the job done. A planner can also be purchased from the dollar store, Target, or Walmart and used to create a budget just fine. The planner world is quite fun and always coming up with beautiful inserts and pieces to incorporate into planners, which can keep the cost up but it is up to you to decide on the route you want to take.

Using a financial planner has kept me organized and also minimally stressed and anxious about money because it keeps track of exactly where my money is going. I can keep all my information in one place and not have to worry about losing important documents or remembering numbers and important dates. Also, If I’m on the go, I keep a replica of my budgets in my personal size Louis Vuitton planner just in case. If you’re thinking about purchasing a planner for your finances…do it! I’m telling you, you will not regret it!!!

*This is not a sponsored post. All items mentioned were purchased with my own money*

With love,

Shara

“Let no debt remain outstanding, except the continuing debt to love one another, for whoever loves others fulfills the law.” Romans 13:8